What's a christmas club?

I have never been in one but here supermarkets advertise that you join and put money aside throughout the year so that you have it available to spend in their store at Christmas. Personally I cannot see the advantage but then I am very good at saving money in the usual places - bank term deposits. Also as my family do not give gifts and Christmas dinner is only a bit more of a splurge than usual, there is no need. I guess they are good for people with large families and low incomes.

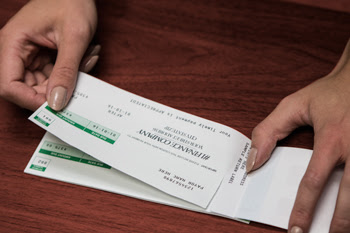

I can remember my parents having Christmas clubs when I was a very small boy. They also had vacation clubs. They all worked the same way. You got a coupon book, and you turned in a coupon with the money.

I think back in the day it was a good way for working-class folk to put money by for Christmas presents. I really don't think any bank here does that anymore. Of course, I'm speaking of 50 years ago, when credit cards were only for the wealthy. And I don't think there were many credit cards other than American Express back then.

I almost never use any kind of checks these days. I rarely even carry cash!

It is weird to think how many once normal things have changed seemingly quickly. I'm reading an Oliver Sacks piece in the New Yorker that he starts by saying his aunt, who lived to old age, said she pretty easily got used to modern inventions like planes and cars and so on. But what she couldn't get used to were the things that had disappeared. "Where are the horses?" she'd always say, recalling the horses and carriages of her youth.

When I first started using a Christmas Club, it was way back, and it was a coupon booklet type thing. You would go to the bank in October or so, and you would tell the teller you wanted to open a Christmas Club, and what the end total you would want (say...$500.00).

You would be given a book full of coupons, each with the same denomination on it. Once a week, you'd go to the bank, tear out one coupon, and give them that set denomination with the coupon.

On the anniversary date of the club being opened, the club would automatically close, and the funds, plus interest, would be mailed to you in check form. This way, by the end of October or beginning of November, you would have your money back, and be able to use it for your holiday shopping.

When I started my current job, I opened a club account here as well, but the coupon books were a thing of the past. I was given a passbook account, and instead of a set denomination, I could deposit as much as I wanted, and on the anniversary date of the account opening, the funds would be automatically transferred to my checking account.

Passbooks are now a thing of the past as well. I can't remember the last time I've seen one. I have 4 different accounts. My main checking account where I pay all my bills. My secondary checking. This is were I hold my funds until I need to use them. A money market for my "don't touch" savings. A statement savings for my holiday funds.

It may seem convoluted, but it makes sense to me!

I get paid, and all the funds are put into my main checking account. I then move half of the money I will need for monthly bills (rent, phone, electric, cable/internet, insurance) to my secondary checking account. On the second payday of the month, the other half of money I will need for the bills gets placed there. This way, it doesn't get accidentally spent. On each payday, $50.00 automatically gets transferred to my statement savings for holiday use only. By the time the holidays come, I have between $1,300.00 - $1,500.00 saved in it. I spend what I have to, and the rest gets put into my money market.

Doing it this way helps to keep stuff organized.

Funds in my main checking account will be my spending cash, gas, groceries, bowling, any money in here I know I can use however I want.

Funds in the secondary checking are earmarked and can't be used for anything other than rent, phone, electric, cable/internet, insurance.

Funds in the statement savings are earmarked for holiday spending. Anything extra gets moved to the money market at the end of the holiday season.

Funds in the money market are saved for occasional emergencies, and big purchases. All the money I spent on my move from my parents' place to my apartment came from the money market. When I buy the new car this year, the funds will be coming from the money market.